PHILOSOPHY

Building value with people we value

3S Capital is a private investment and operating group built around three core verticals: Construction, Real Estate and Manufacturing.

We believe in more than just returns. We invest in people and ideas, and every decision is shaped by integrity, discipline, and long-term value creation.

STRUCTURE | STRENGTH | SOUL

STRUCTURE | STRENGTH | SOUL

PORTFOLIO

Built with Precision Fueled by Conviction

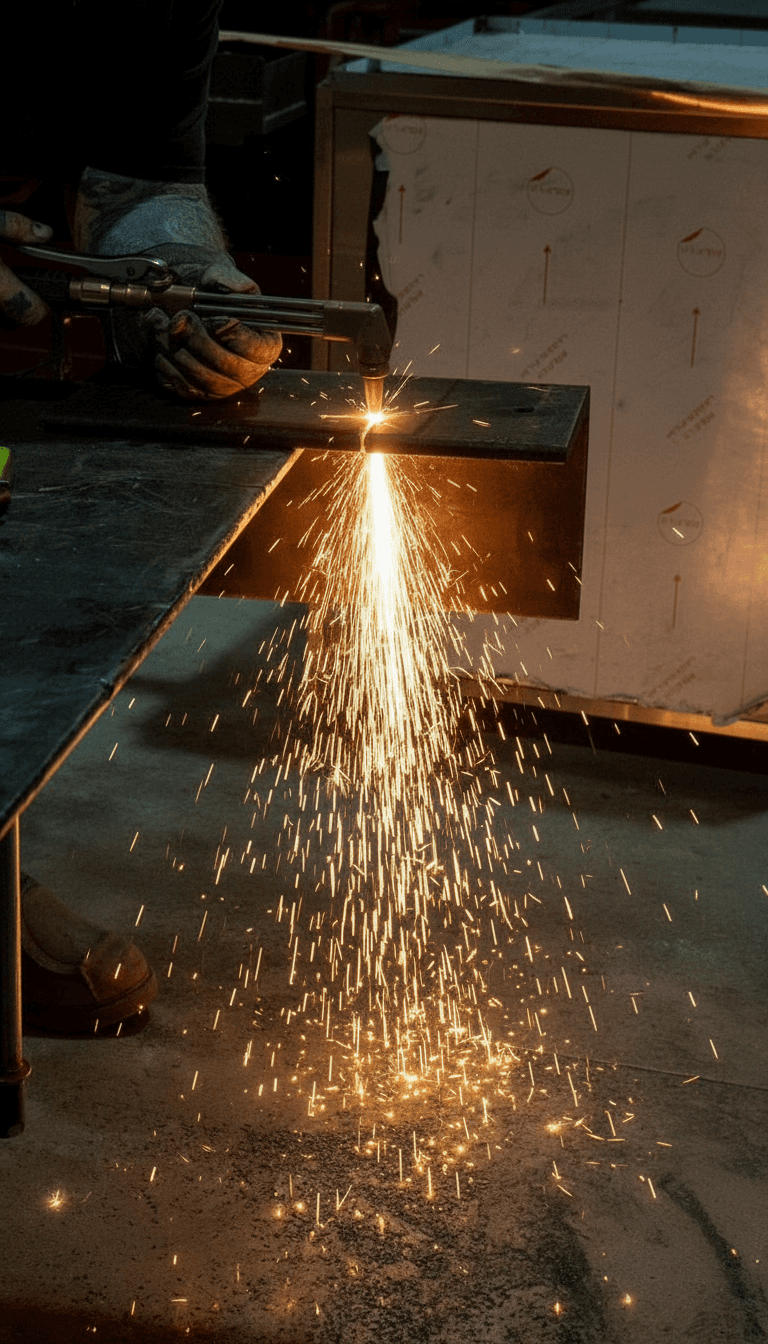

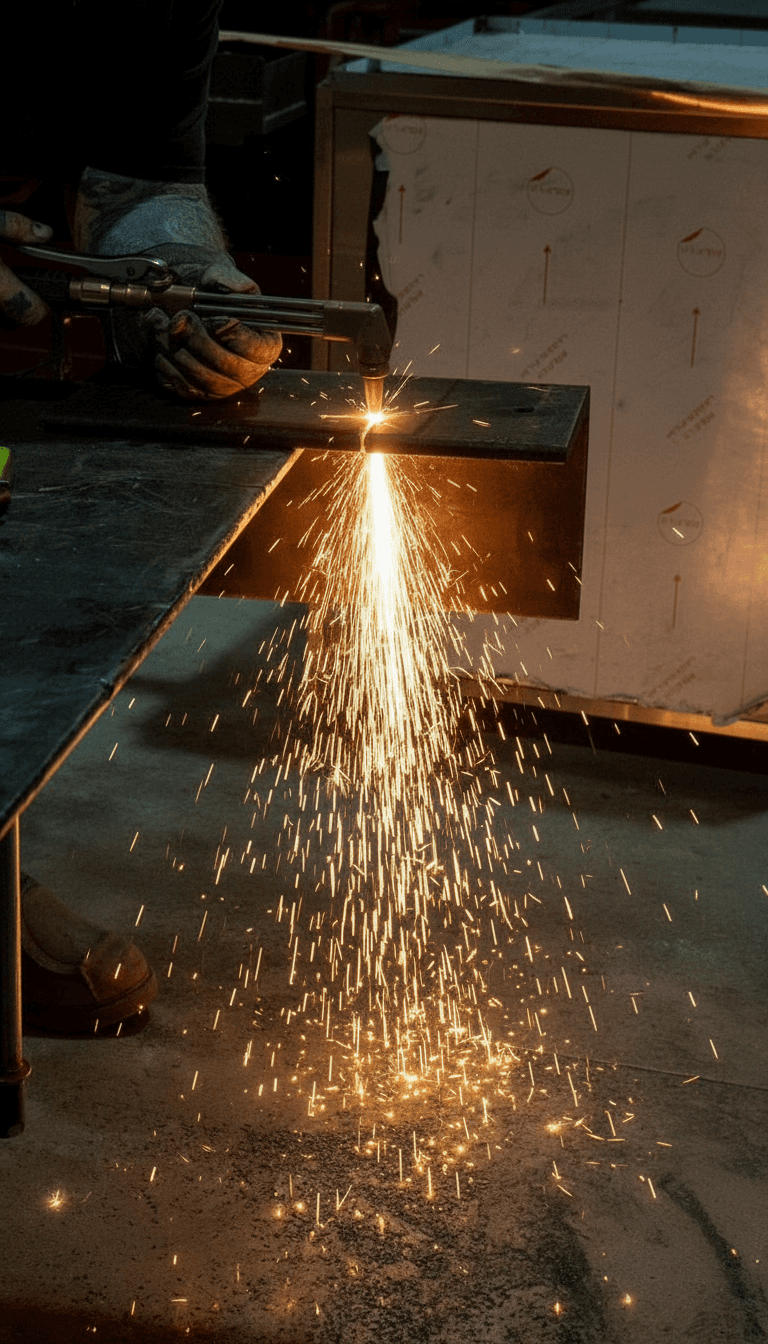

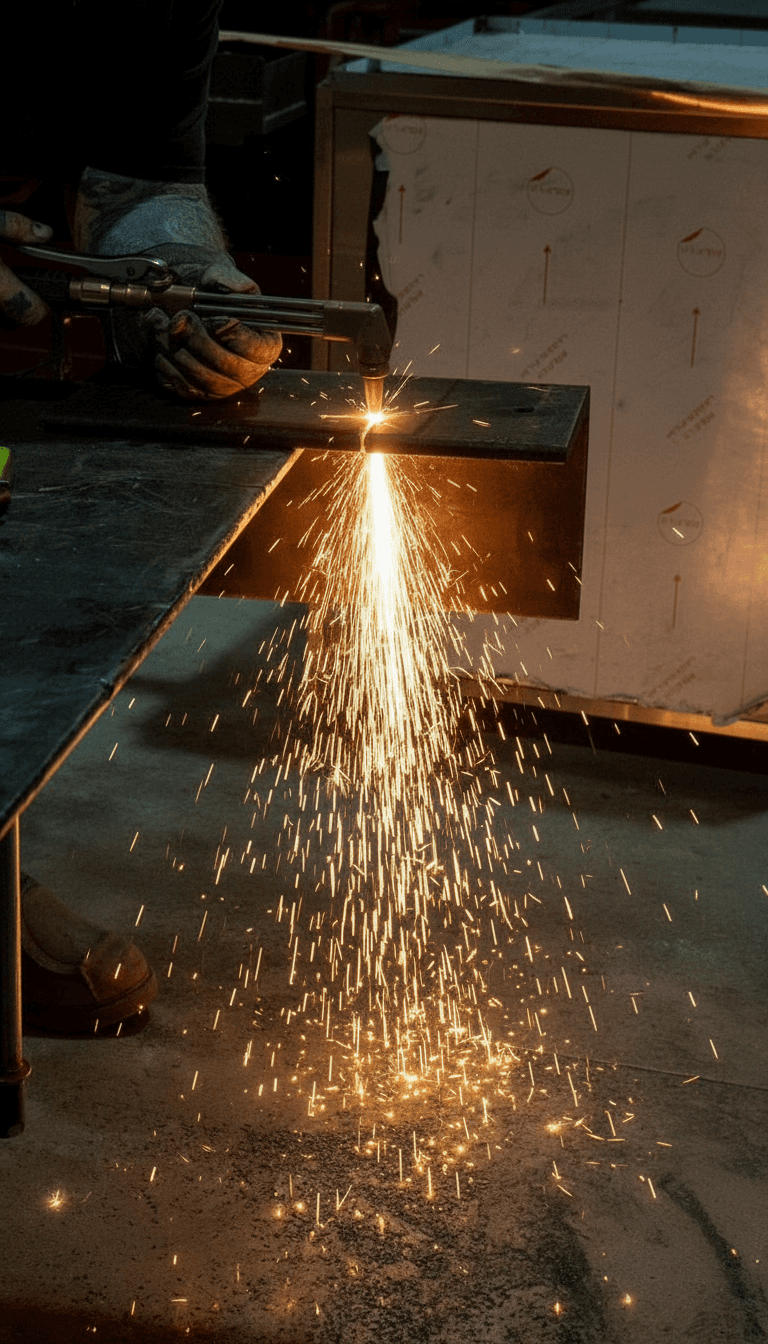

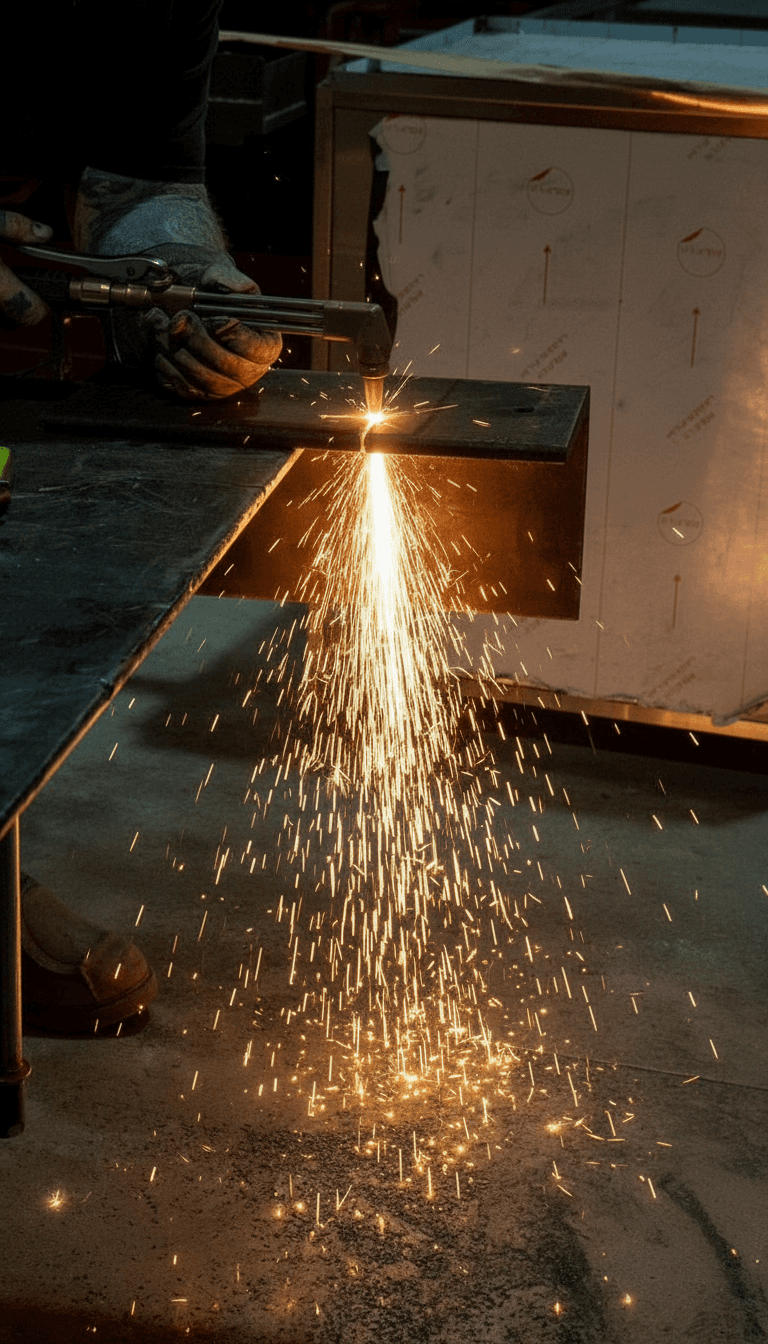

CONSTRUCTION

REAL ESTATE

MANUFACTURING

Our legacy in contracting grounds us in analytical rigour and flexibility, principles that define how we invest today. Construction remains the foundational pillar of our portfolio, representing a long-standing commitment to operational excellence.

PORTFOLIO

Built with Precision Fueled by Conviction

CONSTRUCTION

REAL ESTATE

MANUFACTURING

Our legacy in contracting grounds us in analytical rigour and flexibility — principles that define how we invest today. Construction remains the foundational pillar of our portfolio, representing a long-standing commitment to operational excellence.

PORTFOLIO

Built with Precision Fueled by Conviction

CONSTRUCTION

REAL ESTATE

MANUFACTURING

Our legacy in contracting grounds us in analytical rigour and flexibility, principles that define how we invest today. Construction remains the foundational pillar of our portfolio, representing a long-standing commitment to operational excellence.

PORTFOLIO

Built with Precision Fueled by Conviction

CONSTRUCTION

REAL ESTATE

MANUFACTURING

Our legacy in contracting grounds us in analytical rigour and flexibility, principles that define how we invest today. Construction remains the foundational pillar of our portfolio, representing a long-standing commitment to operational excellence.

APPROACH

Applying Institutional Discipline without Institutional Constraints

Investment Principles

Operational Pillars

Stay close to our capital

Hands-on, direct, accountable

Build with people who share our values

Alignment over opportunism

Invest in what we understand

Clarity before complexity

Think in decades, not quarters

Patience compounds returns

Flexibility

No institutional constraints, we do what's right when it's right

Investment Principles

Operational Pillars

Stay close to our capital

Hands-on, direct, accountable

Build with people who share our values

Alignment over opportunism

Invest in what we understand

Clarity before complexity

Think in decades, not quarters

Patience compounds returns

Flexibility

Not bound by strategy, we follow the strongest ideas wherever they lead

Investment Principles

Operational Pillars

Stay close to our capital

Hands-on, direct, accountable

Build with people who share our values

Alignment over opportunism

Invest in what we understand

Clarity before complexity

Think in decades, not quarters

Patience compounds returns

Flexibility

No institutional constraints, we do what's right when it's right

Investment Principles

Operational Pillars

Stay close to our capital

Hands-on, direct, accountable

Build with people who share our values

Alignment over opportunism

Invest in what we understand

Clarity before complexity

Think in decades, not quarters

Patience compounds returns

Flexibility

No institutional constraints, we do what's right when it's right

LEADERSHIP

Disciplined by Data Driven by Values

Group Chairman

SAMI W. SIDAWI

Sami W. Sidawi brings decades of experience across engineering, contracting, and real estate. From major civil and industrial projects to strategic investments across the globe. As Chairman, his vision and leadership continue to drive growth, innovation, and long-term value across the group’s portfolio.

Group CEO

SAMER S. SIDAWI

Group COO

JIHAD KHOURY

Group Chairman

SAMI W. SIDAWI

Mr. Sidawi brings decades of experience across engineering, contracting, and real estate. From major civil and industrial projects to strategic investments in the UAE and across the globe. As Chairman, his vision and leadership continue to drive growth, innovation, and long-term value across the group’s portfolio.

Group CEO

SAMER S. SIDAWI

Group COO

JIHAD KHOURY

Group Chairman

SAMI W. SIDAWI

Sami W. Sidawi brings decades of experience across engineering, contracting, and real estate. From major civil and industrial projects to strategic investments across the globe. As Chairman, his vision and leadership continue to drive growth, innovation, and long-term value across the group’s portfolio.

Group CEO

SAMER S. SIDAWI

Group COO

JIHAD KHOURY

Group Chairman

SAMI W. SIDAWI

Sami W. Sidawi brings decades of experience across engineering, contracting, and real estate. From major civil and industrial projects to strategic investments across the globe. As Chairman, his vision and leadership continue to drive growth, innovation, and long-term value across the group’s portfolio.

Group CEO

SAMER S. SIDAWI

Group COO

JIHAD KHOURY

NEWS & INSIGHTS

Project milestones, partnerships, media features & more

Update

Jan 10, 2026

3S Development Instagram

We’re pleased to introduce the official 3S Development Instagram, offering a closer look at our projects, process, and progress on site. Follow along as we share key milestones, insights, and the craftsmanship behind our developments.

Update

Jan 10, 2026

3S Development Instagram

We’re pleased to introduce the official 3S Development Instagram, offering a closer look at our projects, process, and progress on site. Follow along as we share key milestones, insights, and the craftsmanship behind our developments.

Update

Jan 10, 2026

3S Development Instagram

We’re pleased to introduce the official 3S Development Instagram, offering a closer look at our projects, process, and progress on site. Follow along as we share key milestones, insights, and the craftsmanship behind our developments.

Update

Jan 10, 2026

3S Development Instagram

We’re pleased to introduce the official 3S Development Instagram, offering a closer look at our projects, process, and progress on site. Follow along as we share key milestones, insights, and the craftsmanship behind our developments.

Update

Sep 12, 2025

The Melgrano Construction Update

The concrete pour of the raft is a key structural milestone, forming the foundation of The Melgrano’s core framework. This marks the commencement of building the structure vertically having completed all foundation and enabling works.

Update

Sep 12, 2025

The Melgrano Construction Update

The concrete pour of the raft is a key structural milestone, forming the foundation of The Melgrano’s core framework. This marks the commencement of building the structure vertically having completed all foundation and enabling works.

Update

Sep 12, 2025

The Melgrano Construction Update

The concrete pour of the raft is a key structural milestone, forming the foundation of The Melgrano’s core framework. This marks the commencement of building the structure vertically having completed all foundation and enabling works.

Update

Sep 12, 2025

The Melgrano Construction Update

The concrete pour of the raft is a key structural milestone, forming the foundation of The Melgrano’s core framework. This marks the commencement of building the structure vertically having completed all foundation and enabling works.

Update

May 9, 2025

AlNasr UAE Annual Management Retreat

The AlNasr UAE Annual Management Retreat brought leadership together to reflect on performance, align strategic priorities, and set direction for the coming 3-5 years. The retreat focused on collaboration, clarity, and long term organisational growth.

Update

May 9, 2025

AlNasr UAE Annual Management Retreat

The AlNasr UAE Annual Management Retreat brought leadership together to reflect on performance, align strategic priorities, and set direction for the coming 3-5 years. The retreat focused on collaboration, clarity, and long term organisational growth.

Update

May 9, 2025

AlNasr UAE Annual Management Retreat

The AlNasr UAE Annual Management Retreat brought leadership together to reflect on performance, align strategic priorities, and set direction for the coming 3-5 years. The retreat focused on collaboration, clarity, and long term organisational growth.

Update

May 9, 2025

AlNasr UAE Annual Management Retreat

The AlNasr UAE Annual Management Retreat brought leadership together to reflect on performance, align strategic priorities, and set direction for the coming 3-5 years. The retreat focused on collaboration, clarity, and long term organisational growth.